what is a reverse home mortgage and how does it function

Reverse mortgage lending institutions, by tapping into your tank of fond memories and a good reputation, are likewise wishing to obtain you to use some of that good old residence equity you have actually developed for many years. Some retirees Inheriting A Timeshare miss the work environment and also their tasks a lot more than they miss out on the money from employment. Functioning a task may include a remarkable way of living adjustment at this stage of your life, however it's one worth enjoyable. A part-time task may be the solution for those retired people who miss the social benefits or feeling of achievement that comes from working. Prior to you go job-hunting, however, see to it you determine how work would certainly affect your tax obligation situation as well as Social Protection advantages.

This is a huge threat if you are currently financially strapped. A reverse mortgage http://remingtonhmbv967.bravesites.com/entries/general/contrast-today-s-existing-mortgage-rates is absolutely not the most inexpensive home loan item. In fact, a standard house equity car loan will likely set you back considerably much less if you can qualify.

- If you choose that you intend to settle the loan and also recover your equity, you have the choice to do that.

- Reverse home mortgages can be a response to your financial petitions.

- If you expect remaining in your residence for a long period of time– Given that you'll pay an additional set of shutting prices with a reverse home mortgage, you need to stay in the house enough time to warrant the cost.

- Retiring and also requiring even more income my investment advisor suggested securing a home loan.

- Like a regular mortgage, you'll pay different charges as well as closing costs that will amount to hundreds of dollars.

If you have actually already repaid your home loan (or didn't have one in the first place), after that the equity amounts to the total market value of the residential property. Chat with a lender about whether a reverse home mortgage is best for you. MyBankTracker has partnered with CardRatings for our protection of charge card products. MyBankTracker as well as CardRatings might get a payment from card providers. Opinions, evaluations, evaluations & suggestions are the author's alone, and have actually not been reviewed, supported or approved by any of these entities. To remain qualified for Medicaid, the reverse home loan property owner would have to handle just how much is withdrawn from the home mortgage in one month to avoid exceeding the Medicaid restriction.

The Suitable Customer

This normally suggests you stay in the house for at the very least six months a year. The Climb's internal home mortgages expert recommends this companyto find a reduced rate – and in fact he used them himself to refi (twice!). Visit this site to learn moreand see your rate. While it doesn't affect our point of views of items, we do receive settlement from partners whose deals show up below. A reverse home mortgage transforms house equity right into cash– without calling for that you move out of your house. However before you jump in, here's what you require to understand about the prospective downsides. The climbing number of seniors acquiring reverse home loans is because of attracting promotions featuring relied on celebrities, such as renowned Canadian number skater Kurt Browning.

What Takes Place To A House Equity Loan When A Residence Goes To Foreclosure?

A reverse mortgage might be a poor idea if leaving a How To Get Rid Of An Llc paid-off residence to your successors is very important to you. The financing equilibrium, including interest, can leave them little to absolutely nothing to acquire from this particular asset. For a government-backed reverse home mortgage, the financing limitation is equal to the conforming car loan limit for a single family residence in a high-cost location. Lending limitations for government-backed reverse home loans do not differ from one area to one more. A reverse home mortgage is a lending versus the equity in your home. Unlike a conventional home loan, there is no sale of the residence entailed.

I am a 45 years seasoned banker who has actually seen numerous elders shed their only property to turn around home mortgages. Your residence will continue to appreciate in value and also offset rate of interest costs as well as loss of equity. If you live away from the house for more than 12 consecutive months, you may need to start paying the funding. If your spouse is a co-borrower or an eligible non-borrowing spouse, they might remain in the house without paying back the loan. For single-purpose reverse home loans, the money's purpose requires to be assessed and approved by the financing firm. In addition, reverse home mortgages often tend to have higher rates of interest than traditional mortgages.

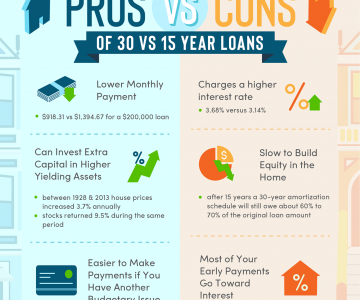

Undergoing FHA laws has an additional benefit– HECM fundings are non-recourse lendings, which implies you'll never ever owe more than what your house deserves, even if its market value decreases. Actually, economists will certainly tell you that you require 10 times your existing wage stuffed in a retirement fund to make it through your gold years. Closing costs for a regular 30-year mortgage may run $3,000.

Ingen kommentarer endnu